Asset management strategy:

In the search for a qualified partner for the asset management, we used a multi-level selection process. As a result, the foundation’s assets are not managed by one bank, but by several asset managers. A so-called Family Office – the renowned company avesco – is in charge of the selection and evaluation of asset managers and investment managers, reviews of ongoing processes and reports to the board.

Goals and criteria of our asset management:

The asset management of the Federal Foundation Magnus Hirschfeld aims to maintain equity on a long-term basis. Assets shall be invested in a secure and profitable way. We are especially proud of our principles of asset management that are aligned to investing in correspondence with all aspects of sustainability and avoiding investments in countries where homophobic laws are in effect.

Asset investment:

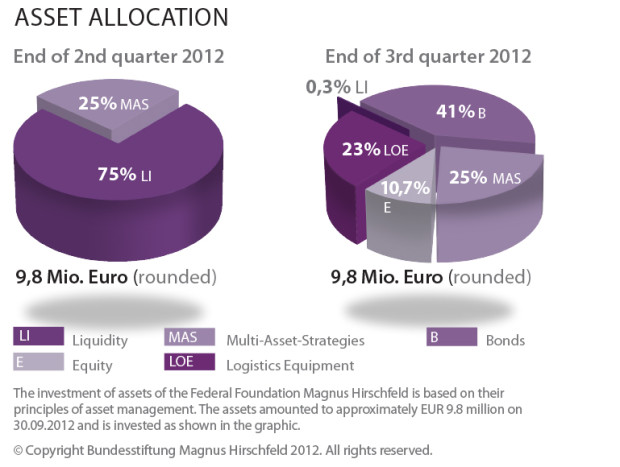

The foundation’s assets are divided into four different investment branches. All branches complement each other and follow the principle of a broad risk diversification.

The first investment branch is designed according to the investment principles of the asset investment of Harvard and Yale. The branch is composed by a broad and diverse portfolio, investing e.g. in shares, convertibles, private equity and wood.

The second investment branch is dedicated to placing funds in sustainable investments. With the help of a method developed by avesco and the entrepreneurial university Munich (Technische Universität München TUM) called Ö2SE, the investments are chosen after evaluating all aspects of sustainability (economic, ecological, social and ethic factors).

Investment examples are: solar, wind and hydroelectric power stations, microfinance and social impact investment. The third investment branch focuses on investments in European companies and the financial involvement of companies with solid accounts and a sustainable business model.

The fourth investment branch is focused on loaning logistics equipment. Logistics is the circulation process that keeps economy alive, and compared to world economy, it has grown steadily with factor 2 in the last decades. The foundation benefits from that development by funding logistics equipment and loaning it to logistics companies.