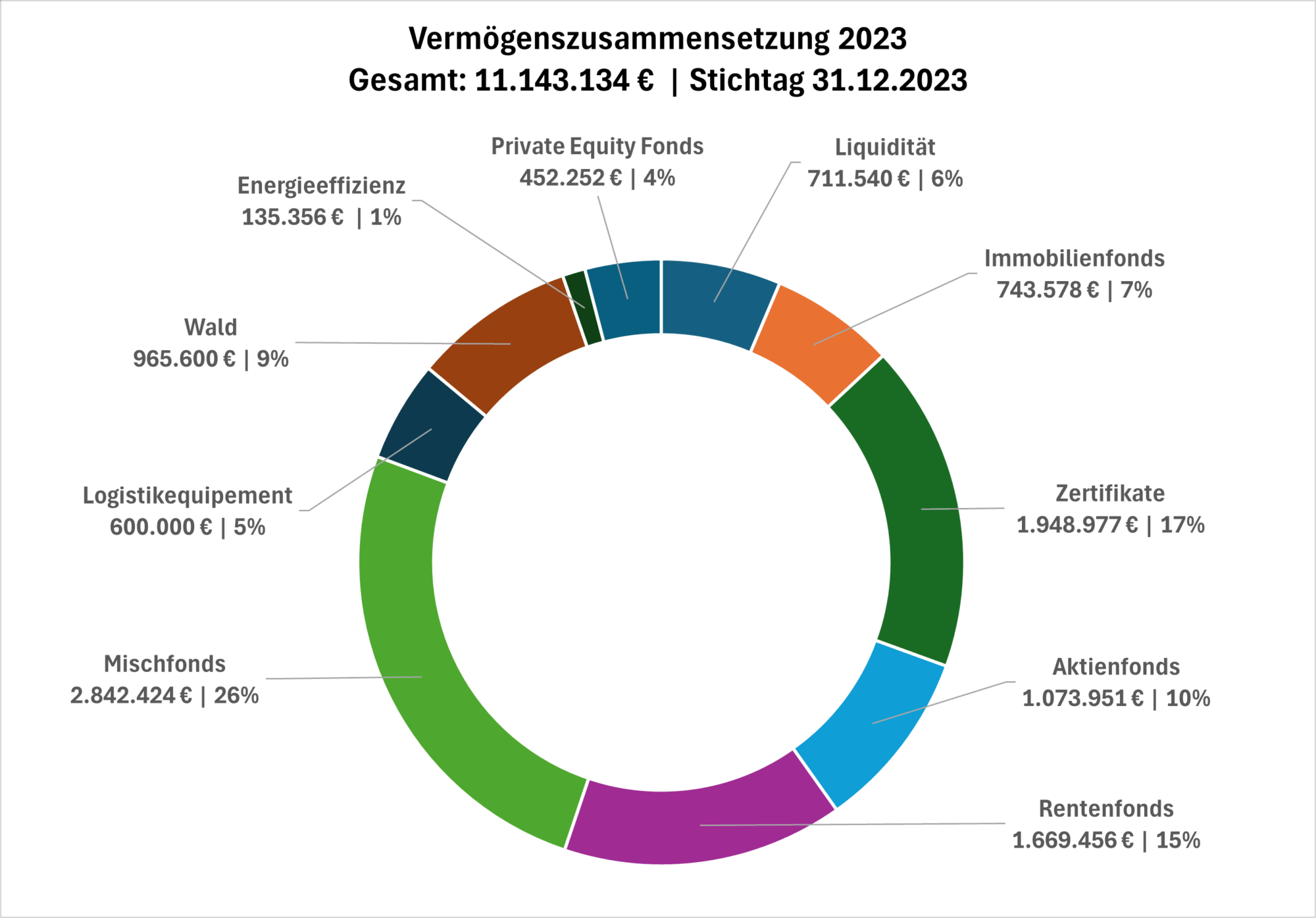

The assets of the Bundesstiftung Magnus Hirschfeld are based on its principles of asset management. The value of the invested assets is invested as shown in the graphic.

Note: The asset allocations shown here are based on the report of the asset manager HONORIS Treuhand GmbH (as of April 30, 2024). Our activity report for 2023, which was published later, also reports on any necessary value adjustments made by the auditor.

Investment strategy

The foundation’s assets have been managed by HONORIS Treuhand GmbH since the second quarter of 2020, replacing the long-standing administrator, avesco Financial Services AG.

In accordance with the foundation’s asset management principles, HONORIS takes care of ongoing monitoring and reporting to the board of directors. In addition, the asset structure is gradually being made less risky.

Goals and criteria of the asset investment

The asset investment of the Foundation is long term and oriented to preservation of capital. Apart from the profitable investment of the assets, aspects such as the sustainability of the investments and avoiding investments in states with homophobic criminal law must be taken into account in the context of the investment guidelines.

Asset investment

In the past, asset investments were divided into two segments: the segment of listed securities investments and the segment of direct investments in various asset classes, such as private equity, logistics, sustainable energy generation and the real estate sector. Some of these investments were also made through fund solutions or the granting of subordinated loans.

In both segments, the focus was and is on sustainability aspects.

Currently, around 62 percent of assets are invested in the securities investments segment, while around 38 percent are tied up in other investments. In the future, the securities sector will continue to grow due to maturing direct investments and new investments in liquid assets.

The Bundesstiftung Magnus Hirschfeld (BMH) takes part in the transparent civil society initiative.